We've got your back

Sterling OMS Admin Console

Explore the step-by-step resources for the settings and custom configurations in the Sterling Order Management System.

Explore the step-by-step resources for the settings and custom configurations in the Sterling Order Management System.

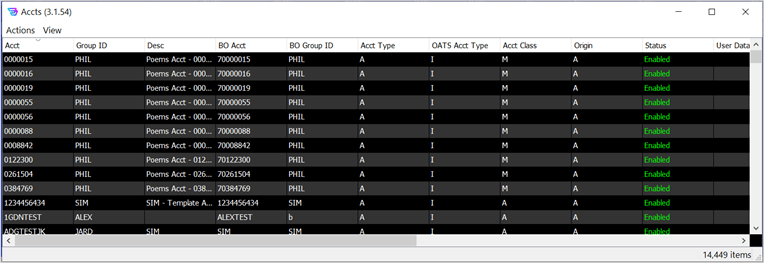

To view/edit the list of Accounts:

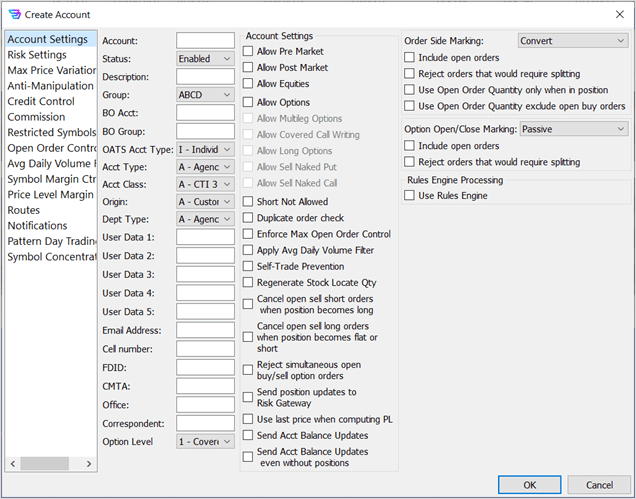

Upon clicking Create Account, a window appears where you can define a new account, as shown below.

Note: Settings defined in the Account window are always superseded by any similar settings in account’s Group settings window.

| Field Name | Description |

| Account | Sterling Account Number. |

| Status | Operational status of the account. Values: Enabled, Disabled, Allo… (Allow account to only close open positions and cancel orders.) |

| Description | Brief text description or name of the account. |

| Group | The Group in which the account is included. Use pull-down list to select from existing Groups. |

| BO Acct | Back Office account, defined by clearing firm. |

| BO Group | Back Office Group, defined by Sterling. |

| OATS Acct Type | The legacy OATS account type for the group. Values: A - Institutional, C - Combined, E - Employee, I - Individual, O - Market making, P - Other proprietary, U - Unknown, X - Error account |

| Acct Type | The account type, used in regulatory reporting. Values: A – Agency (broker acting as customer’s agent), P – Principal (broker trading for its own account) |

| Acct Class | The account class type, also used in regulatory reporting. Select using pull-down list. |

| Origin | The account class type, used in regulatory reporting. Select from pull-down list. |

| Dept. Type | The department type, used in regulatory reporting. Select from pull-down list. |

| User Data 1-5 | Free-form text fields describing the user, for improvisational usage. |

| Email Address | Email address for account contact. |

| Cell number | Phone number for account contact. |

| FDID | Firm Designated ID (FDID) for the account, in the Consolidated Audit Trail (CAT) system. |

| CMTA | Code identifying the Clearing Member Trade Agreement partner. |

| Office | The customer’s branch office |

| Correspondent | The relevant broker dealer. |

| Option Level | The approved option trading level. Select from pull-down list. |

| Account Settings | |

| Allow Pre Market | Select to permit pre-market trading. |

| Allow Post Market | Select to permit post-market trading. |

| Allow Equities | Select to permit equities trading. When deselected, equities trading is not permitted. |

| Allow Multileg Options | Select to permit multileg complex options spreads. |

| Allow Covered Call Writing | Select to permit buying a stock and selling a call option to open against the stock, i.e., covered calls. |

| Allow Long Options | Select to permit long options positions, i.e., grant permission to purchase options contracts. |

| Allow Sell Naked Put | Select to permit sell naked put options, i.e., grant permission to sell a put option to open a position without having a short position on the underlying stock. |

| Allow Sell Naked Call | Select to permit sell naked call options to open a position, i.e., grant permission to sell a call option without possessing the underlying stock. |

| Short Not Allowed | Select to prohibit short selling stock. |

| Duplicate order check | Select to monitor and reject orders when duplicate orders appear by a defined number of identical orders within a specified amount of time, indicating a possible submission malfunction. |

| Enforce Max Open Order Ctrl | Select to enable a limit on the number of orders. See also the Groups/Open Order Control window (previously described). |

| Apply Avg Daily Volume Filter | Select to prohibit trading of equities with low average daily volumes. Selected when a firm does not want its traders to trade low activity stocks. The low volume threshold is set on the Groups/Avg Daily Volume Filter window (previously described). |

| Self-Trade Prevention | Select to prevent the entry of simultaneous, complementary buy and sell orders (i.e., wash orders) for equities. See also the Allow Groups/Wash Instructions window (previously described). |

| Regenerate Stock Locate Qty | Select to make available the located stock borrow quantity after closing a previous short position it was used on. |

| Cancel open sell short orders when position becomes long | Select to automatically cancel open sell short orders when the customer’s position becomes long in that security. |

| Cancel open sell short orders when position becomes flat or short | Select to automatically cancel open sell long orders when the customer’s position becomes flat or short in that security. |

| Reject simultaneous open buy/sell option orders | Select to reject the entry of contemporaneous buy and sell orders for options. |

| Send position updates to Risk Gateway | Include position updates in all Sterling REST API messages, such as those to the OMS Risk Manager system (i.e., Risk Gateway). This selection effectively will share risk positions in an ongoing way to external subscribers. |

| Use last price when computing PL | Select to employ the last sale in the market (rather than current bid/ask) when computing profit/loss. |

| Send Acct Balance Updates | Include account balance updates in all Sterling REST API messages, such as those to the OMS Risk Manager system (i.e., Risk Gateway). This selection effectively shares risk positions in an ongoing way to external subscribers. |

| Send Acct Balance Updates even without positions | Include account balance updates even when position do not exist in all Sterling REST API messages, such as those to the OMS Risk Manager system (i.e., Risk Gateway). |

| Equity Order Side Marking | |

| Include open orders | Select to include shares in open (i.e., unfilled) buy and sell orders (in “netting” with the current position) when calculating remaining overall long shares that may enable marking new orders as sell long. |

| Reject orders that would require splitting | Select to reject all orders that would require the original order to be converted and split into two orders with some shares marked long and some shares marked short. |

| Use Open Order Quantity only when in position | Select to not include open sell orders during marking validation when entering sell orders without a long position (i.e., only include sell open orders when the orders are covering a long position). |

| Use Open Order Quantity exclude open buy orders | Select to exclude open buy orders when calculating position for sell order marking (i.e., do not “net” buy and sell orders to determine marking). |

| Option Open/Close Marking | |

| Include open orders | Select to include open (i.e., unfilled) orders (in addition to current actual position) when calculating position, during open/close position order marking. |

| Reject orders that would require splitting | Select to reject all orders that would require the order to be split, during open/close position marking. |

| Rules Engine Processing | |

| Use Rules Engine | Select to enable the use of Sterling’s Rules Engine and Review and Release feature when monitoring/checking pre-trade order activity. |