We've got your back

Sterling Trader® Pro Guide

Sterling's user manuals are continuously updated digitally. Explore the step-by-step resources in the product user guides to sharpen your trading & risk management skills.

Sterling's user manuals are continuously updated digitally. Explore the step-by-step resources in the product user guides to sharpen your trading & risk management skills.

Each tab and setting is clickable with how-to steps and additional information

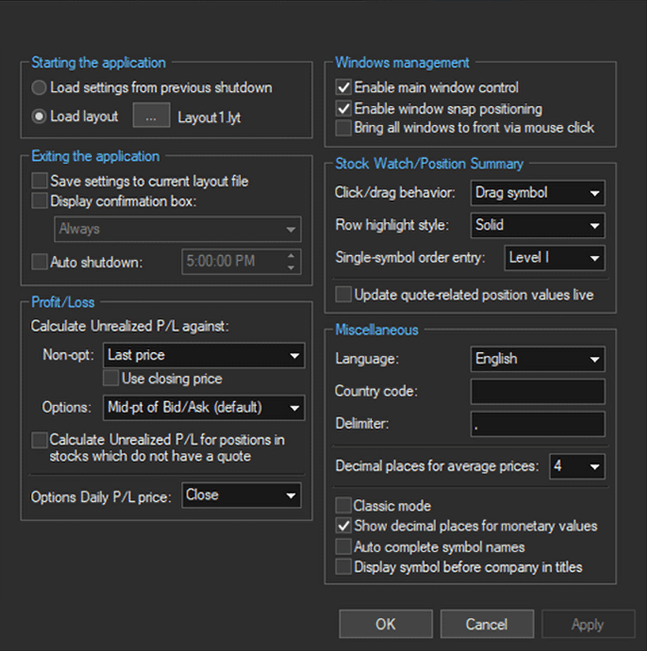

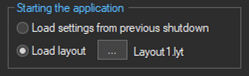

Load Settings from Previous Shutdown

Loads the layout at your last shutdown. If your system goes down unexpectedly, this setting will reload the layout as it was when you lost connection. It does not save the layout but reloads the previous settings.

Load Layout

Select a saved layout to automatically load upon logging in. Click the "..." button to choose the layout

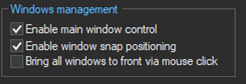

Enable main window control

Moving the main application window will also move all other windows. Holding the CTRL button down allows the main window to move independently.

Enable window snap positioning

Windows will be auto-positioned near other close windows when moving or resizing.

Bring all windows to front via mouse click

Clicking any window will bring all platform windows to the front.

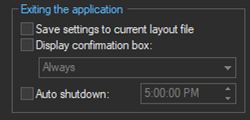

Save Settings to Current Layout File

Saves your layout when exiting the platform. A new layout file is not created, the current layout file is overwritten.

Display Confirmation Box

Display a confirmation box every time you exit or only to alert you to open orders, open positions, or both

Auto shutdown

Designate a time for the platform to automatically shut down each day

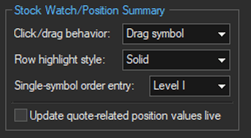

Click/drag Behavior

For left-click/drag behavior, choose to either drag the selected symbol into Level I, Level II or chart windows or to highlight the selected row.

Row Highlight Style

When highlighting a row, select to either fill in the entire row (Solid), or only highlight the border around the row (Border).

Single-Symbol Order Entry

Update Quote-Related Position Values Live - P/L and other values will be recalculated with every new tick.

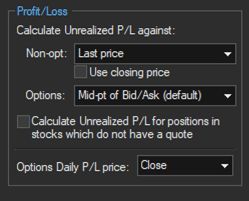

Calculate Unrealized P/L against

For Non-opt (Stocks), unrealized P/L can be calculated using the Last Price or current Bid/Ask Price. When selecting Last Price, you can use the previous day's closing price.

For Options, unrealized P/L can be calculated using either the current Bid (when long)/ Ask (when short) price or the Mid-point of the current Bid/Ask price.

Calculate Unrealized P/L for positions in stocks which do not have a quote

Options Daily P/L price

Select which price to use for calculating intraday P/L. Close (prior closing price) or Opening Pos (price traded when the position was opened).

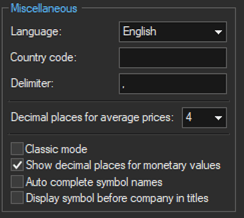

Language

Change the platform language. The change requires a restart of the program.

Country code

The extension entered for symbols that trade on a foreign exchange.

Delimiter

Specify the delimiter

Decimal Places for Average Prices

Select the number of decimal places to display in average price fields.

Classic mode

Switches the platform to or from the Classic mode color theme

Show decimal places for monetary values

Choose whether to display monetary values with or without decimals

Auto Complete Symbol Names

Automatically completes symbol names as you type

Display Symbol Before Company in Titles

Place the symbol before company name in the title bar of order entry windows

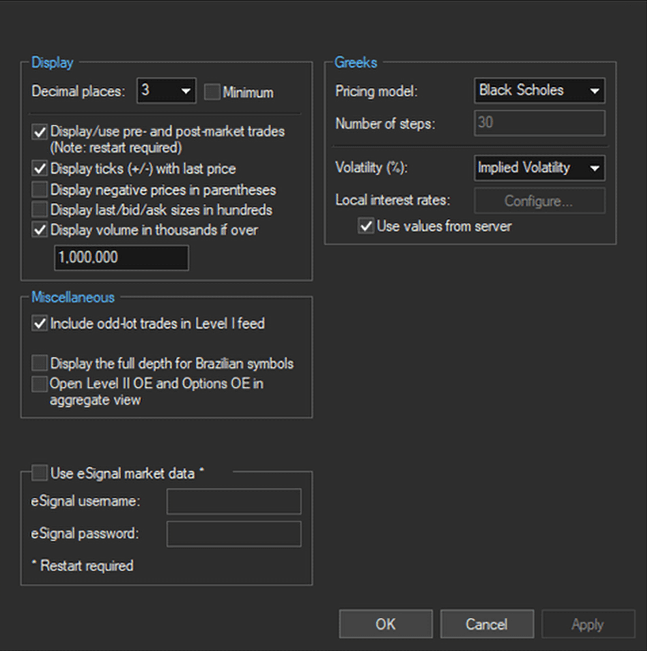

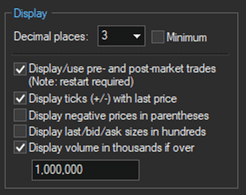

Decimal Places

The number decimal places used for prices and other numerical data. Check the Minimum box to display longer decimals only when the values are present.

Display/Use Pre- and Post-Market Trades

Pre/post-market trades will be shown and factored into calculations

Display Ticks (+/-) With Last Price

Add a “+” or “–” designation to last price fields to indicate whether the last price was up or down from the previous last price

Display Negative Prices in Parentheses

Adds ( ) around negative numbers

Display last/bid/ask sizes in hundreds

Display sizes in round lot factors of 100

Display Volume in Thousands If Over

Volumes will be displayed in multiples of 1,000 if over this threshold

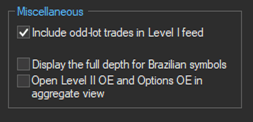

Include odd-lot trades in Level I feed

Display the full depth for Brazilian symbols

Open Level II OE and Options OE in aggregate view

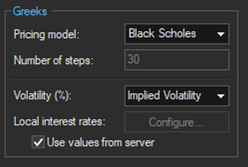

Pricing Model

Select to use either Black Scholes or Binomial pricing models for Greek calculations

Number of steps

Designate the number of steps to use in the Binomial model calculation

Volatility (%)

Select Implied Volatility or Server Volatility.

Local interest rates

Elect to use values from server or Configure your own

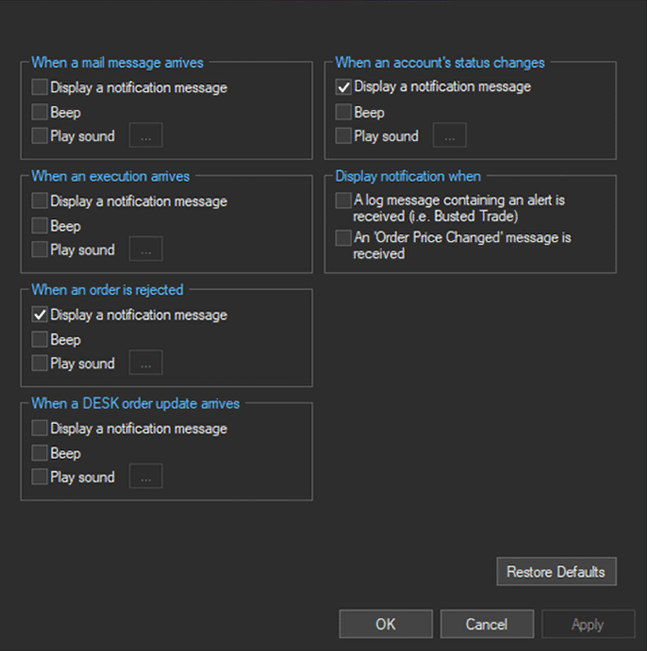

Click on any of the boxes to check/enable the desired platform notifications.

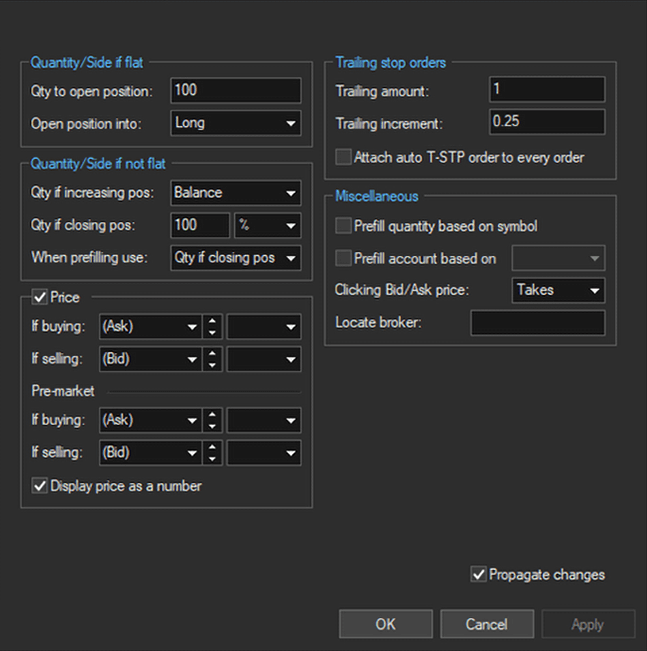

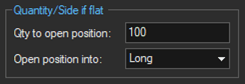

Qty to open position

Default quantity used in an order entry screen when there is no position in a symbol

Open Position Into

Choose Long or Short. Highlights either the BUY or SHRT button in the order entry screen when there is no position in a symbol

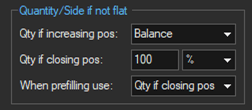

Qty if increasing pos

Qty to open position – existing position

Qty if closing pos

Define either a % of the existing position or specify a share quantity

When prefilling use

Choose to prefill the quantity using either the Qty if increasing pos or Qty if closing pos method

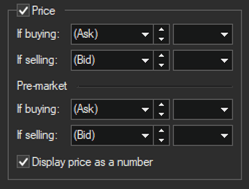

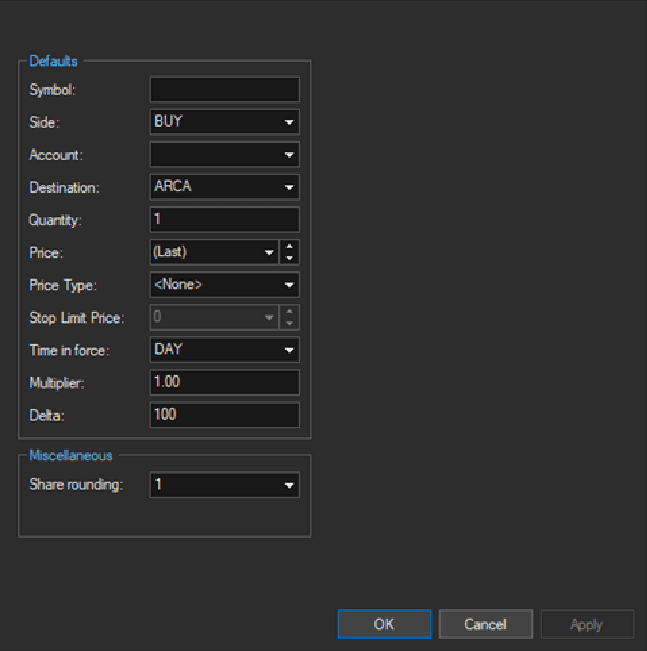

Set the default prices when buying or selling for both the pre-market and regular trading sessions.

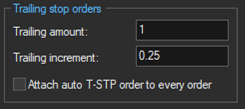

Trailing amount

Specify the amount the stop order trigger price will trail the current price

Trailing increment

The amount the stock must move for the stop trigger price to adjust

Prefill quantity based on symbol

Prefills the quantity field with the quantity used in the last order for the symbol

Prefill account based on

Select Activity to use last account traded or Opg pos to use the account which had a position in the selected symbol

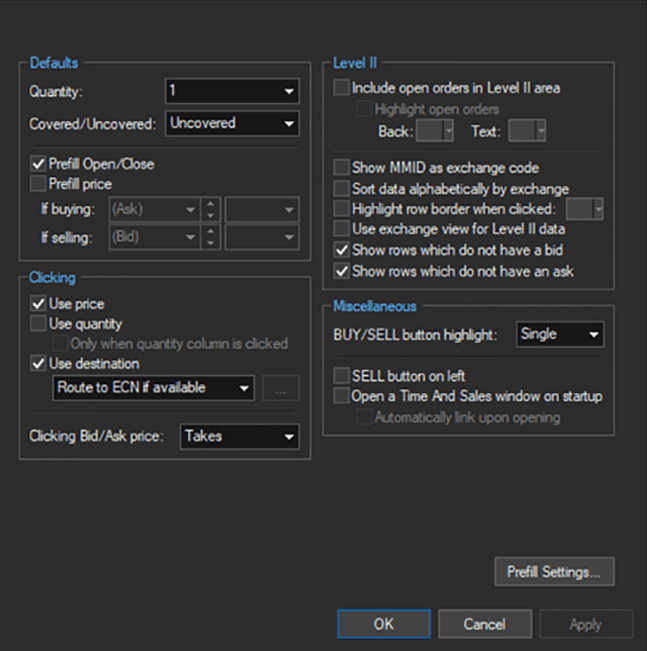

Clicking Bid/Ask Price

Select either Takes or Joins. If Joins is selected, clicking on the Bid price in an order entry window will highlight the BUY button, clicking on the Ask will highlight the SELL or SHRT button. If Takes is selected, clicking on the Bid price in an order entry window will highlight the SELL or SHRT button, clicking on the Ask will highlight the BUY button.

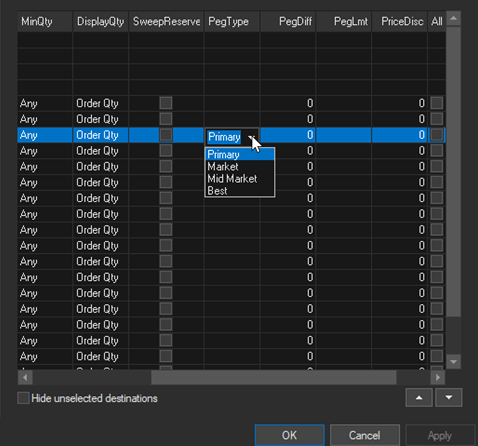

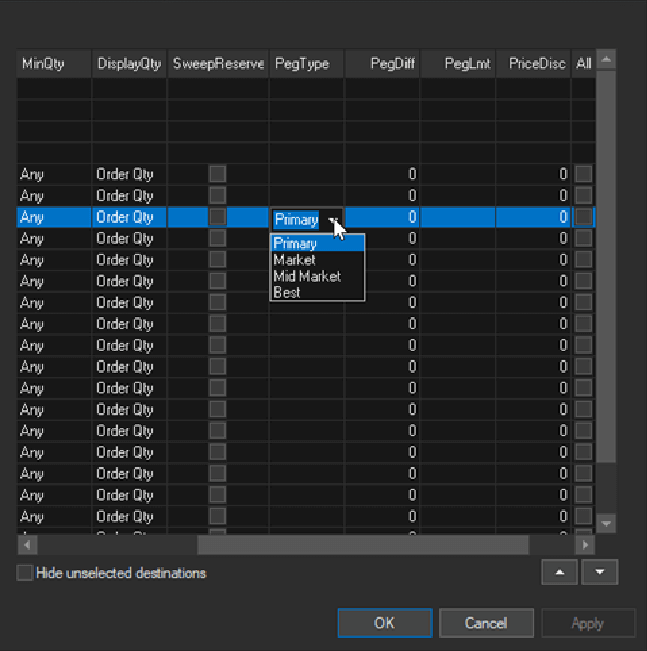

If available, set Peg order defaults by destination

Add/remove items from OE window dropdown menus.

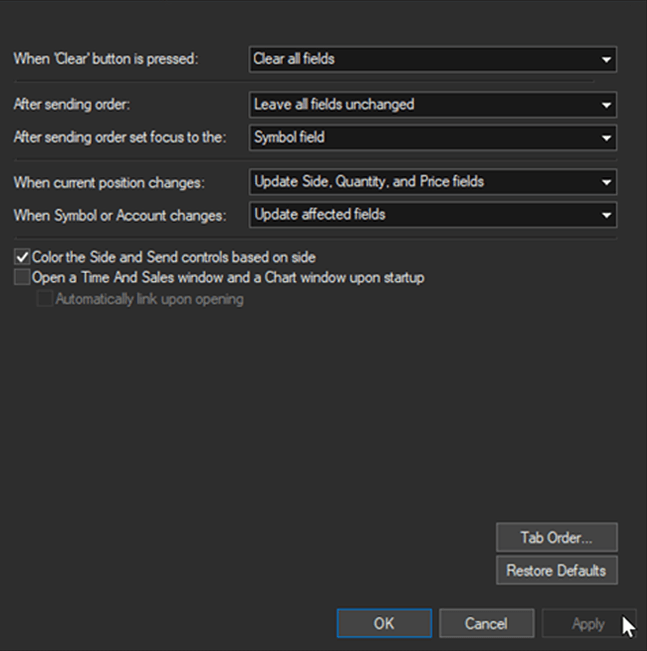

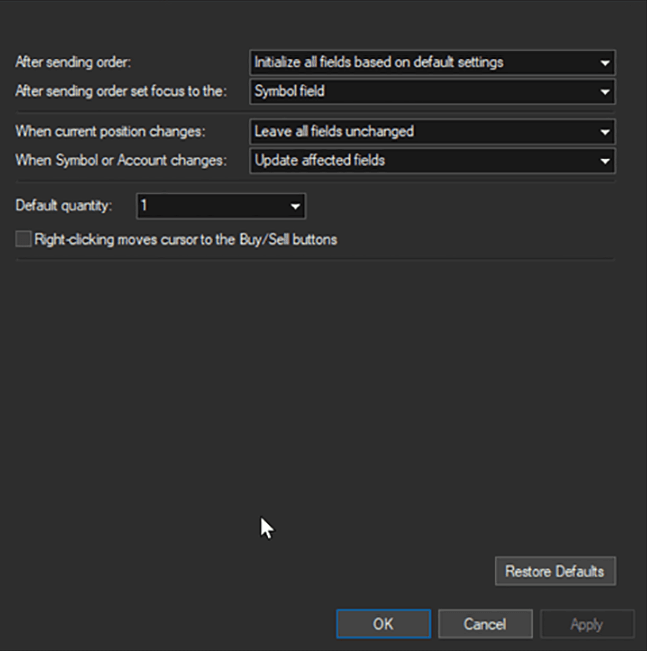

Elect to either clear all fields or initialize all fields based on local Order Entry settings.

Designate handling of the Level I fields after an order is sent.

Designate the field that will be active after sending an order.

Choose to update side, quantity and price fields or leave fields unchanged.

Choose to update affected fields or leave all fields unchanged.

The Side and Send fields will be filled with a color to designate the side of the order (Buy=blue, Sell=red, Sell Short=purple).

A Time and Sales window and Chart will open automatically when a new Level I OE window is opened.

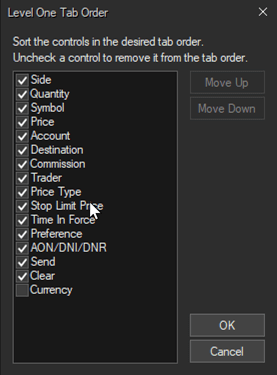

Opens a window where the active field Tab key cycle order can be set.

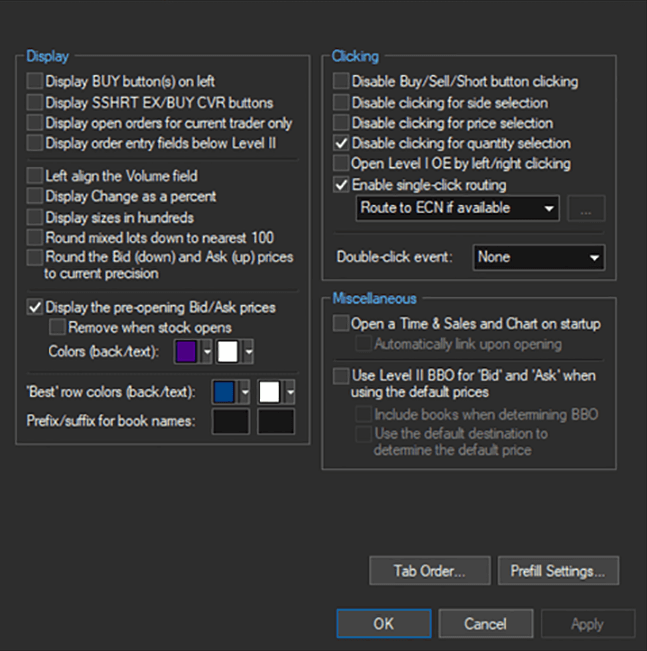

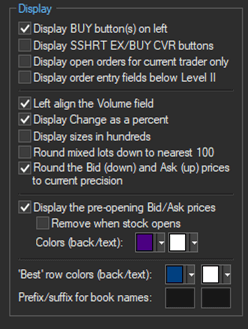

Display BUY button(s) on left

laces the BUY button to the left of the SELL button

Display SSHRT EX/BUY CVR buttons

Adds SSHRT EX/BUY CVR buttons to the Level II window

Display open orders for current trader only

Only orders for the currently selected trader will be displayed

Display order entry fields below Level II

Moves the order entry fields to the bottom of the Level II window

Left align the Volume field

Aligns the volume value on the left side of its cell

Display Change as a percent

Displays change on the day as a percent instead of a dollar value

Display Sizes in Hundreds

Bid/ask sizes will be displayed in round lots of 100. 100 will be displayed as 1, 200 will be displayed as 2, 300 will be displayed as 3.

Round mixed lots down to the nearest 100

Quantities that are not in even lots of 100 will get rounded down to the nearest 100 lot

Round the Bid (down) and Ask (up) Prices to Current Precision

Rounds bid/ask prices up or down to the designated decimal precision

Display the pre-opening Bid/Ask prices

Display pre-open markets and elect to remove when the stock opens

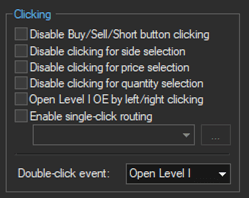

Disable Buy/Sell/Short button clicking

Disables clicking of Buy, Sell and Short buttons

Disable clicking for side selection

Clicking on the bid or ask side will not select the side of the order

Disable clicking for price selection

Clicking on a bid or ask price will not change the order price

Disable clicking for quantity selection

Clicking on a bid or ask quantity will not change the order quantity

Open Level I OE by left/right clicking

Elect to open a Level I OE window when clicking on the bid or ask

Enable single-click routing

Clicking on a row will change the order destination to the Maker in that row

Double-click event

Elect to open a Level I window when double clicking on the bid or ask

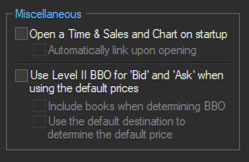

Open a Time & Sales and Chart on startup

A Time and Sales window and Chart will open automatically when a new Level II OE window is opened

Designate handling of the Level I fields after an order is sent.

Designate the field that will be active after sending an order.

Choose to update side, quantity and price fields or leave fields unchanged.

Choose to update affected fields or leave all fields unchanged.

Set the default quantity or elect to use the current position.

Assign the primary global setting defaults that will populate the top bar of the Basket window.

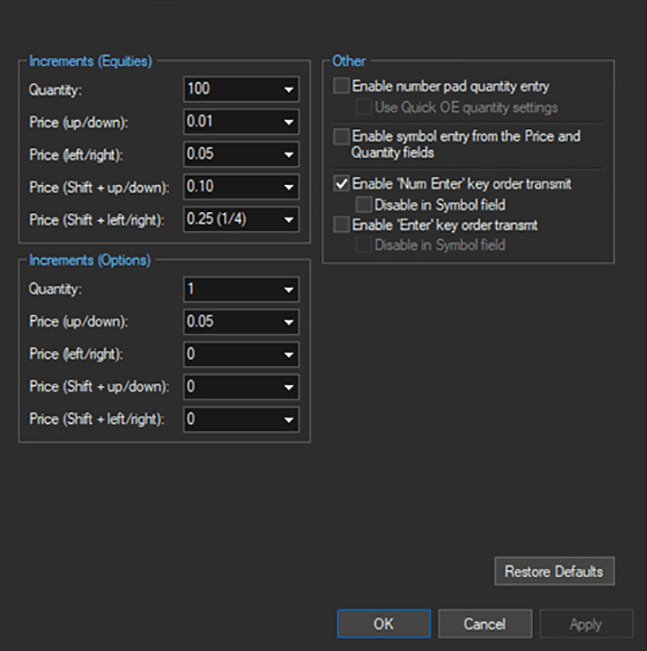

Set price and quantity adjustment increments when using the keyboard or OE price/quantity box arrows.

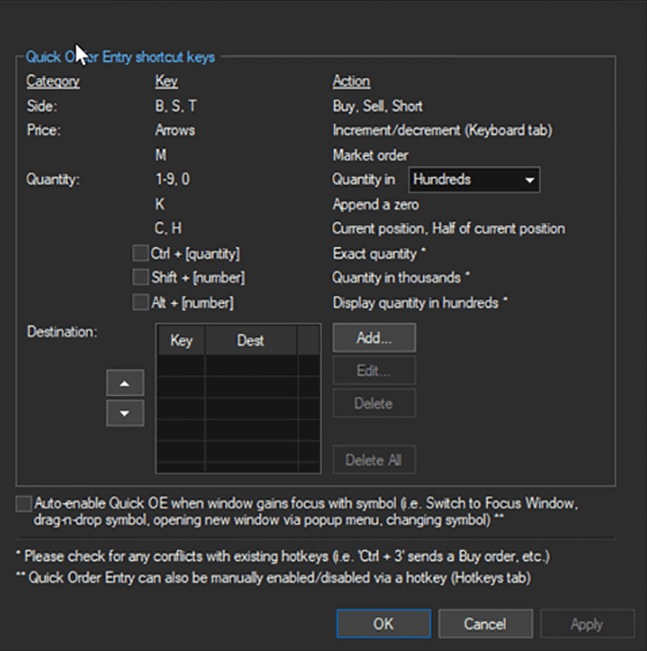

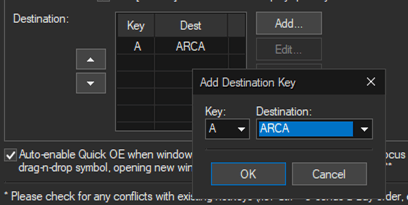

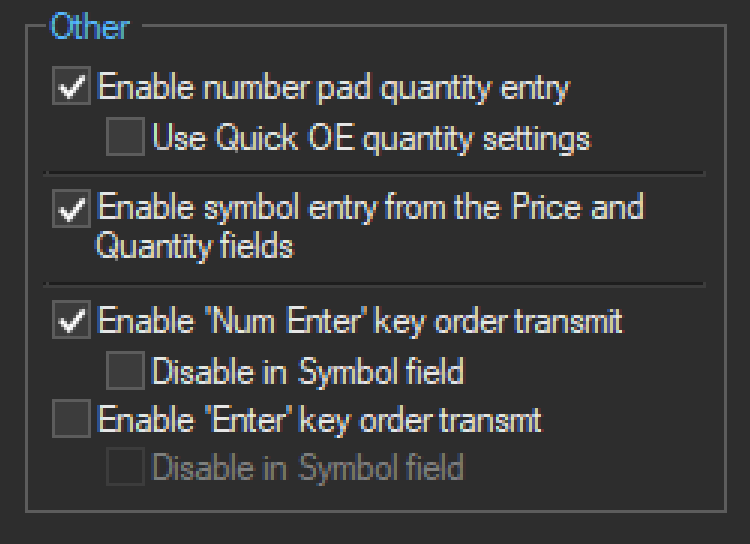

Enable number pad quantity entry

Allows for quantity adjustment using the keyboard number pad

Use Quick OE quantity settings

Number pad adjustments will use the Quick OE settings

Enable symbol entry from the Price and Quantity fields

Symbols can be typed in when the Price and Quantity fields are the active cells

Enable ‘Num Enter’ key order transmit

Pressing the number pad Enter key will send the order

Enable ‘Enter’ key order transmit

Pressing the keyboard Enter key will send the order

Set price and quantity adjustment increments when using the keyboard or OE price/quantity box arrows.

Set price and quantity adjustment increments when using the keyboard or OE price/quantity box arrows.

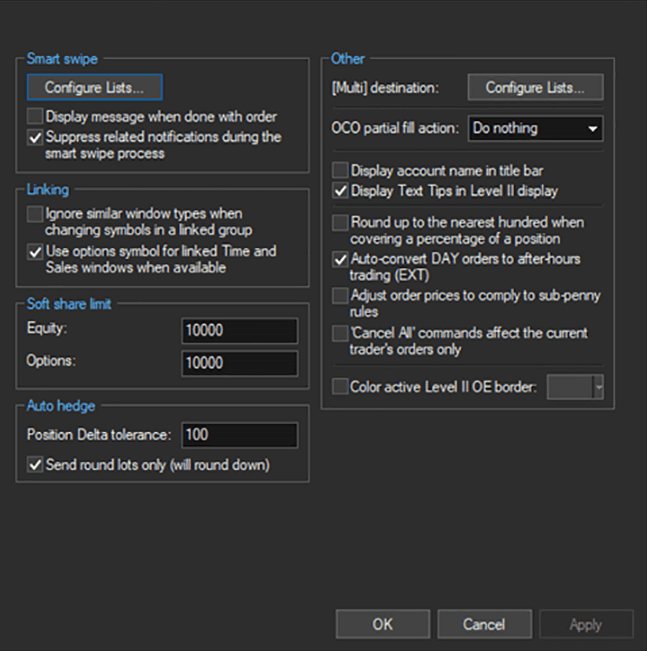

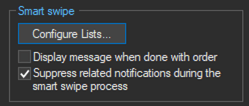

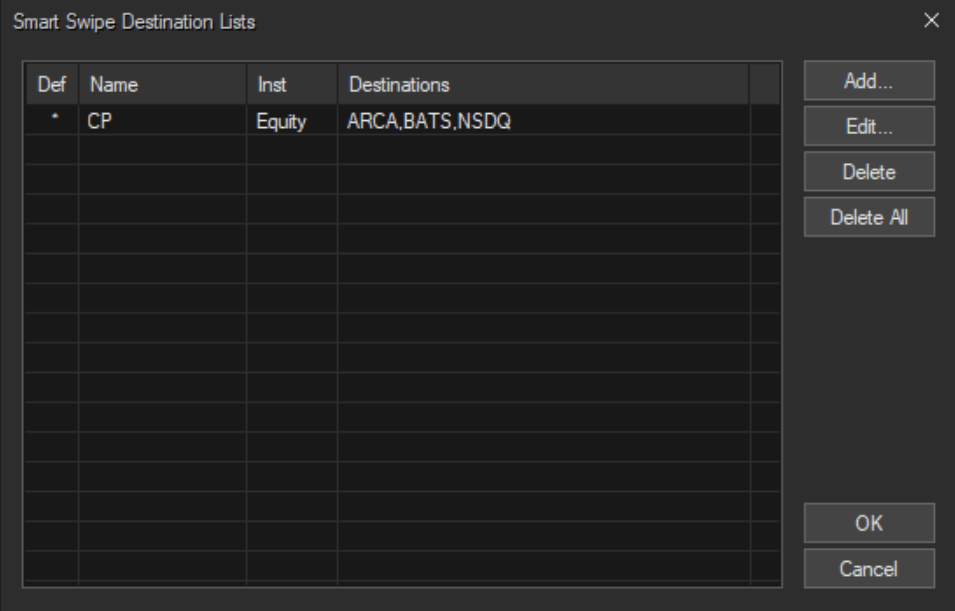

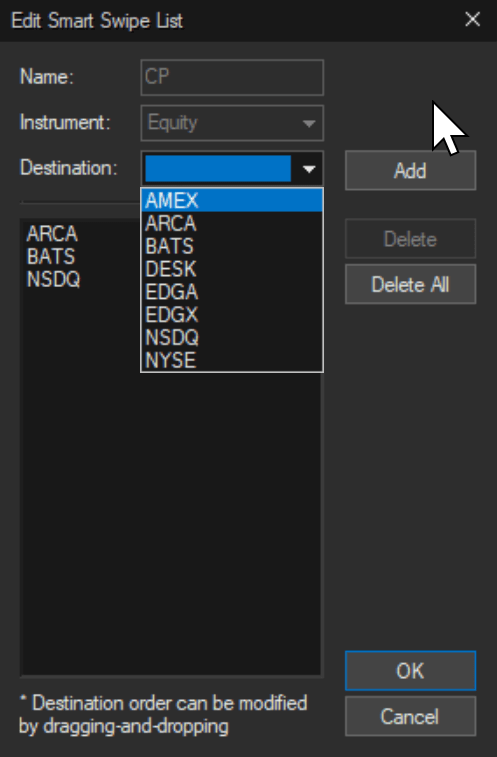

Configure lists for use with the Smart Swipe function.

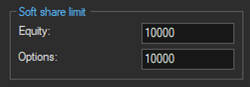

A confirmation window will display for any order with a quantity greater than the designated soft share limit.

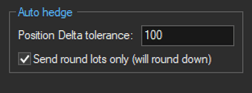

The system will automatically hedge options positions when the delta tolerance is reached.

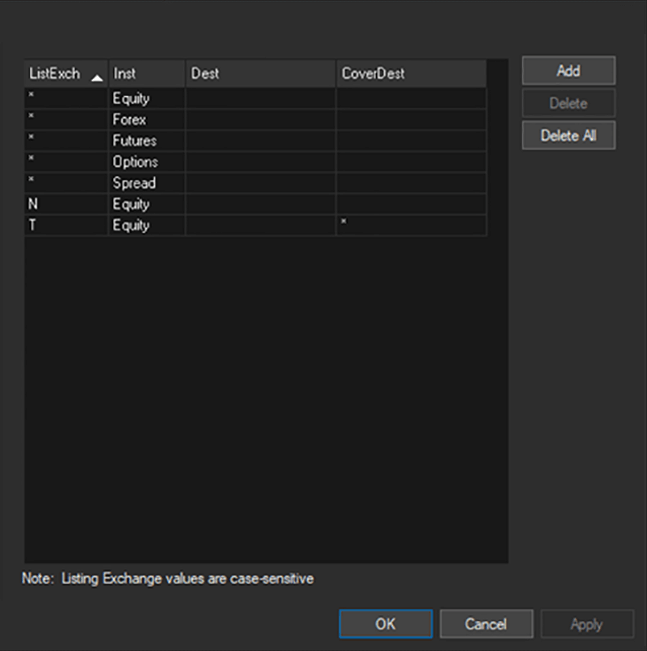

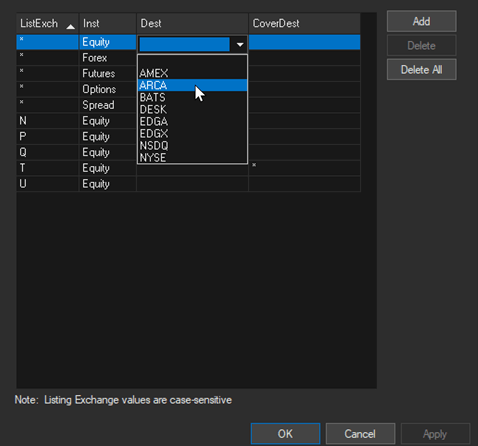

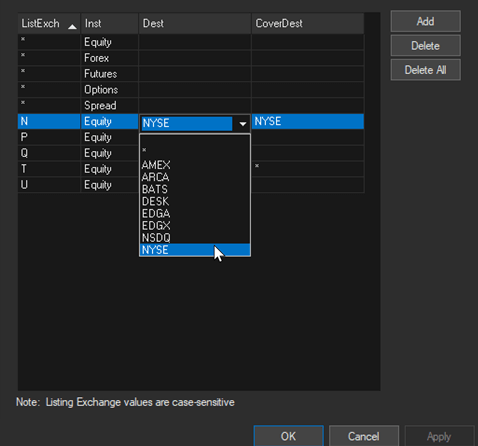

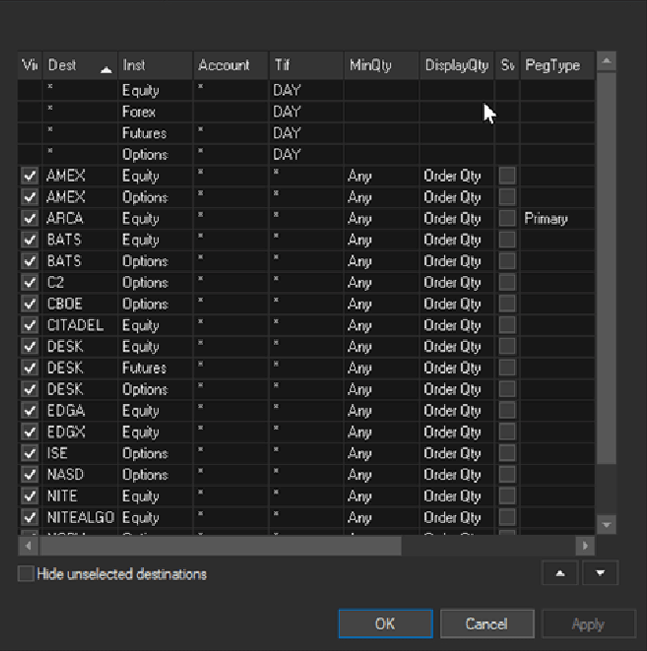

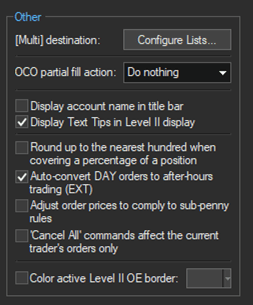

Multi destination

configure the Multi destination to send an order simultaneously to multiple exchanges

Q: If I have more than one Interactive Brokers account, are they able to link up in a single Sterling platform subscription?

A: Yes, you may have multiple Interactive Brokers accounts linked to your Sterling subscription.

Q: I have 2 accounts with 2 different brokers, can I have one Sterling Platform subscription?

A: No, a Sterling platform subscription is per brokerage account. If you use 2 brokerages, you would have to have 2 Sterling platform subscriptions.

Q: I am new to using the Sterling Trader® Pro platform, where can I find basic setup information & help?

A: Please CLICK HERE to check out our Sterling Trader® Pro User Guide

Q: What should I do if I have questions about my account or my account balance?

A: Please check with your broker regarding all inquiries related to your account. As your software provider, your brokerage handles all access and permissions related to your account.

Q: What is the price for each of the trading platforms you offer?

A: Platform pricing is set by your broker and varies based of trading needs.

Q: I cannot log-in to my Sterling platform, what should I do?

A: Settings for your account such as account status, login configuration, Username & Password are controlled by your broker. Please contact your broker directly for all account inquires.

Q: How do I add or remove market data feeds?

A: Market Data feeds are controlled by your broker. Please contact your broker directly for all market data feed inquiries including starting and stopping service.

Q: How do I sign up for a simulated account?

A: STT does not currently offer Sterling Trader® Pro Simulator accounts to individuals. Please send an email to [email protected] and we will refer you to brokers offering our simulator product. Pricing is set by the broker and varies based on trading needs.

Q: Do you have any Brokers that offer Canadians accounts?

A: There are multiple brokers that offer Sterling platforms to Canadian residents for both the US and Canadian markets. Please send an email to [email protected] and we will refer you to brokers offering our products.